Loan Application Management

Last Updated: October 27,2025 Document Version: 1.0 **Prepared for:**Emgage HRMS Implementation Team

Streamlined Employee Loan Handling

The Loan Application Management module simplifies how administrators and employees manage loan requests — from applying and calculating EMIs to tracking approval and disbursement stages.

Overview

Key Benefits This feature enables both HR/Admins and employees to:

- Apply Digitally: Employees can submit loan requests online.

- Automate EMI Calculations: Instant EMI breakdown based on entered amount and tenure.

- Track Request Status: Real-time updates on approval, pending, or disbursed loans.

- Centralized Policy Access: Review applicable loan policies before submission.

- Transparency: Maintain full visibility from request creation to disbursement.

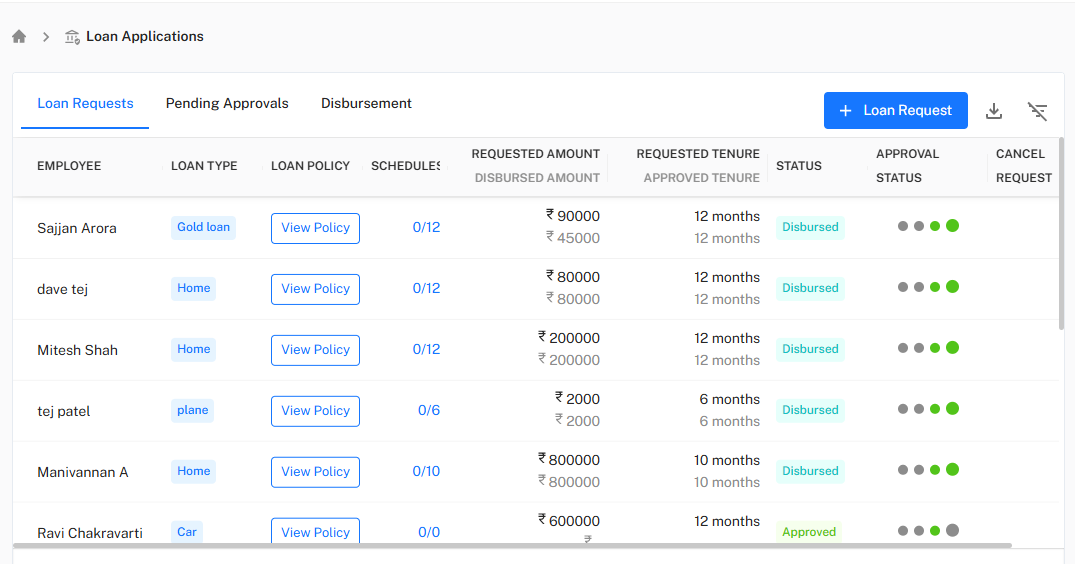

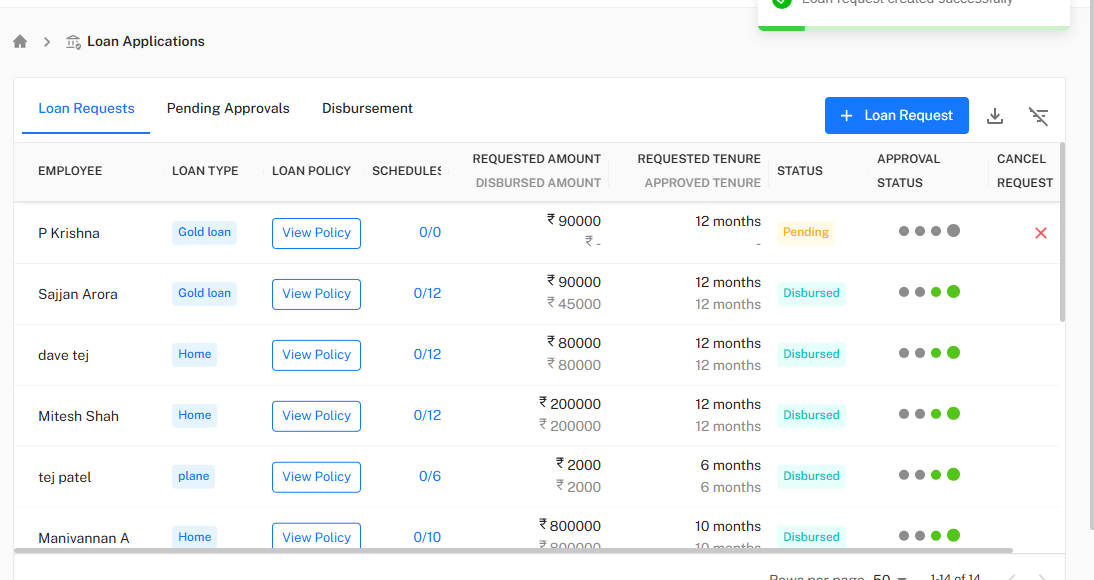

Step 1: Viewing Existing Loan Requests

Navigate to Loan Applications → Loan Requests to view all ongoing and past loan records.

Each record displays:

- Employee Name

- Loan Type (e.g., Home, Gold, Car, Personal)

- Loan Policy (with quick “View Policy” button)

- Schedule (e.g., 0/12 payments completed)

- Requested Amount & Disbursed Amount

- Requested Tenure & Approved Tenure

- Status (e.g., Pending, Disbursed, Approved)

- Approval Status indicators

- Cancel Request option

!Loan Request Table

Example For instance, Sajjan Arora has a Gold Loan with ₹90,000 requested and ₹45,000 disbursed over 12 months.

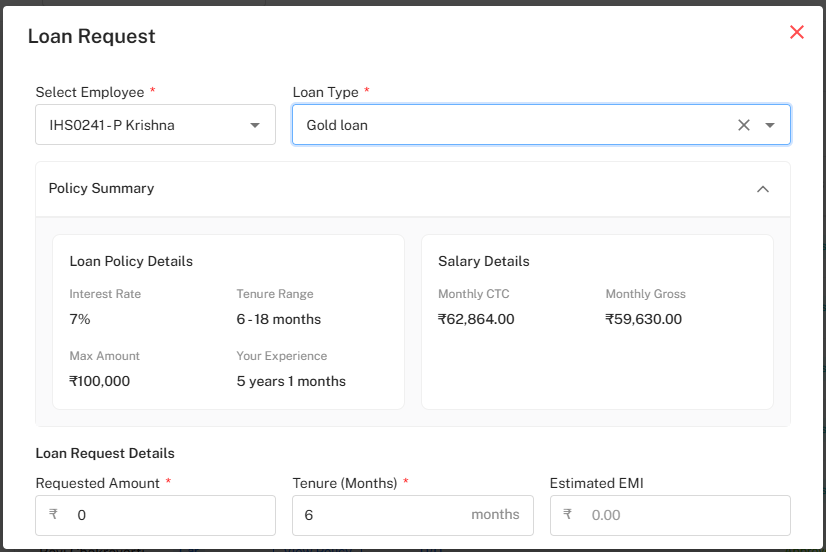

Step 2: Creating a New Loan Request

Click on the + Loan Request button to initiate a new loan.

Click on the + Loan Request button to initiate a new loan.

!Loan Request Button

Fill Out Loan Request Form

- Select Employee – Choose the applicant’s name from the dropdown.

- Select Loan Type – Choose the applicable category (e.g., Home, Gold, Car).

- The Policy Summary auto-populates with:

- Interest Rate

- Tenure Range

- Maximum Amount

- Employee Experience

- Salary Details (CTC & Gross)

!Loan Request Form

Auto Policy Display Selecting the loan type instantly loads the associated Loan Policy and Salary Details, ensuring transparency before proceeding.

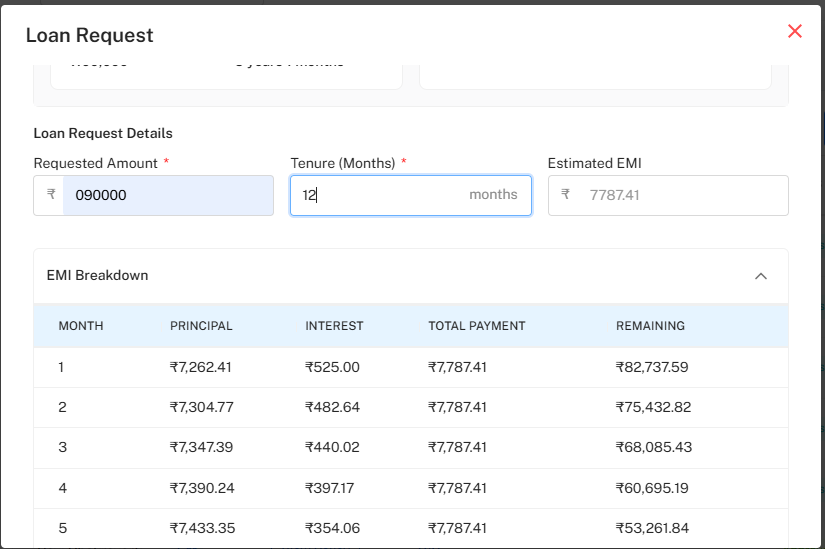

Step 3: Entering Loan Details and EMI Calculation

Fill in the following fields under Loan Request Details:

- Requested Amount (₹)

- Tenure (Months)

- The system auto-calculates the Estimated EMI based on loan parameters.

Below, an EMI Breakdown Table appears showing:

- Month Number

- Principal

- Interest

- Total Payment

- Remaining Balance

!EMI Breakdown Table

Instant EMI Estimation Once the amount and tenure are entered:

- The EMI breakdown is generated automatically.

- Each row shows the decreasing balance month by month.

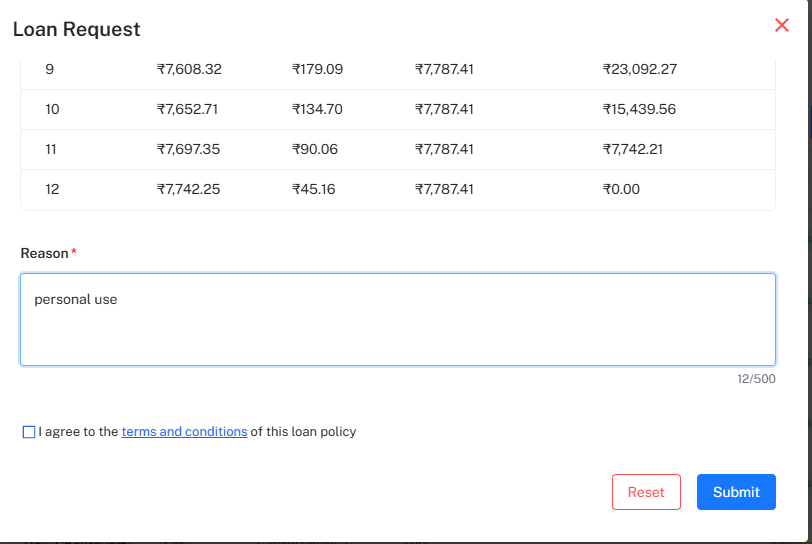

Step 4: Submitting the Loan Request

Complete the remaining fields before submission:

Complete the remaining fields before submission:

- Reason – Enter purpose (e.g., personal use, medical, renovation).

- Terms & Conditions Checkbox – Must be accepted to proceed.

- Use Reset to clear fields or Submit to send the request.

!Submit Loan Request

Confirmation Message Upon successful submission, a message appears: "Loan request created successfully"

Step 5: Tracking Request Status

Return to the Loan Requests tab to view the updated list.

- The new request appears with Pending status under the Status column.

- Once approved by the admin, it moves to Disbursed or Approved states.

- The Approval Status dots visually represent progress.

- You can also Cancel a pending request before approval.

!Pending Loan Request Status

Status Indicators

- Pending – Waiting for approval.

- Disbursed – Loan amount released.

- Approved – Ready for disbursement.

- Rejected – Request declined by admin.

Step 6: Admin and Disbursement View

Admins can switch to the Pending Approvals or Disbursement tabs to:

- Review and approve pending loan applications.

- Manage EMI schedules and disbursed amounts.

- Monitor completion progress (e.g., 0/12 installments paid).