Loan Policy Management

Last Updated: October 27,2025 Document Version: 1.0 **Prepared for:**Emgage HRMS Implementation Team

Flexible Loan Policy Configuration The loan policy module enables administrators to create and manage comprehensive loan policies with customizable eligibility criteria, loan terms, and configuration requirements. Policies can be tailored for different loan types and employee groups.

Policy Creation Overview

Comprehensive Policy Benefits Loan policy management provides structured control over employee lending programs, allowing organizations to:

- Define Multiple Loan Types: Create policies for Personal, Home, Car loans and Salary Advances

- Set Eligibility Criteria: Configure experience-based eligibility and employee qualification rules

- Control Loan Parameters: Define interest rates, tenure ranges, and amount limits

- Ensure Compliance: Configure approval workflows and documentation requirements

- Manage Risk: Set limits on active loans and requests per employee

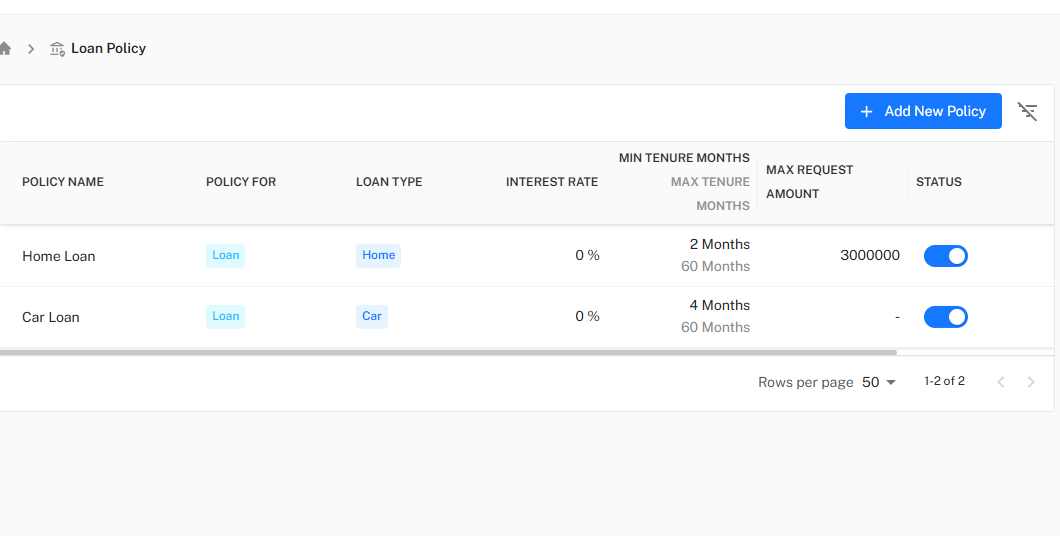

Step 1: Basic Policy Information

This step involves setting up the fundamental policy details and eligibility criteria.

Policy Foundation

!Basic Policy Configuration

Basic Policy Workflow Step-by-Step Configuration:

-

Policy Identification:

- Policy Name: Assign a descriptive name for identification

- Final Approver: Designate the ultimate approval authority (e.g., "AJAY NANDAN")

- Status: Set policy as Active or Inactive

-

Policy Scope:

- Policy For: Select applicable loan types (Loan, Salary Advance)

- Loan Type: Specify the category (Personal, Home, Car, etc.)

-

Eligibility Framework:

- Days to consider for one year: Define the annual calculation basis (typically 365 days)

- Min Gap Between Two Loans: Set cooling period between loan applications (e.g., 180 days)

- Employee Loan Limits: Configure maximum active loans (e.g., 2) and active requests (e.g., 3)

Eligibility Calculation

Eligibility Configuration Options Advanced Eligibility Settings:

- Eligibility Amount Calculation On: Base calculation on CTC GROSS FIXED or other compensation components

- Experience-Based Eligibility: Enable tiered eligibility amounts based on employee tenure

- Approval Requirements: Configure MI/M2 approval requirements

- Request Limits: Set caps on the number of loan requests

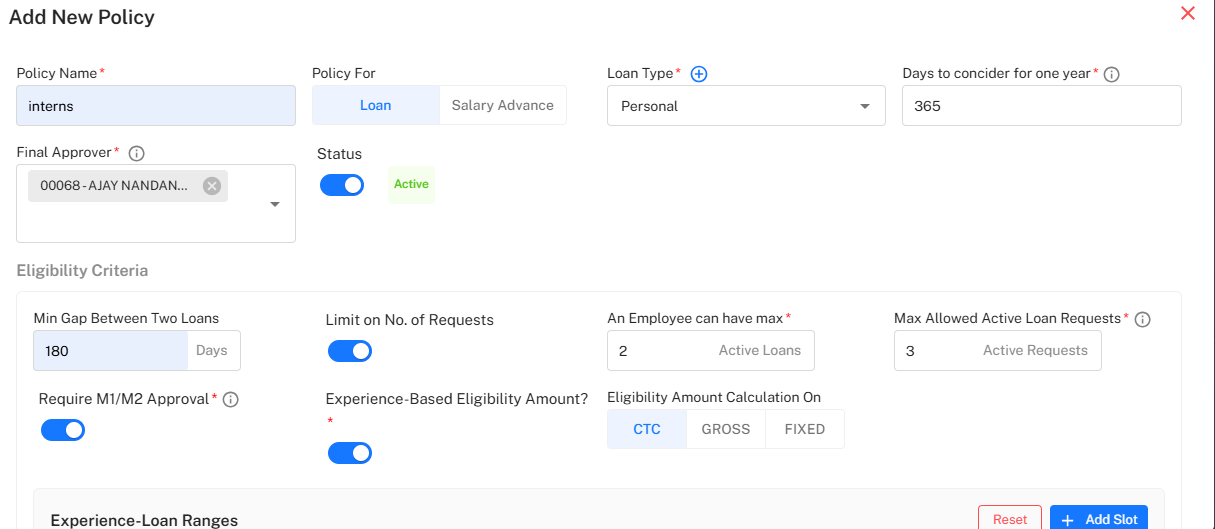

Step 2: Experience-Based Loan Ranges

Configure tiered eligibility amounts based on employee experience levels.

Experience Slots Configuration

!Experience-Loan Ranges Interface

Experience-Based Eligibility Tiered Eligibility Structure:

-

Define Experience Tiers:

- MIN EXPERIENCE: Set the lower bound (e.g., 2 Months)

- MAX EXPERIENCE: Set the upper bound (e.g., 12 Months)

- ELIGIBLE AMOUNT: Define percentage of CTC (e.g., 7% of CTC)

-

Manage Multiple Tiers:

- Use + Add Slot to create additional experience ranges

- Reset to clear current slot configurations

- Build progressive eligibility scales for different experience levels

Policy Applicability

Targeted Policy Application Applicability Criteria:

- Select Applicability Criteria: Define which employee groups the policy affects

- Employee Selection: Target specific employee categories or individuals

- Exclusion Rules: Use "Not" conditions for exclusion-based applicability

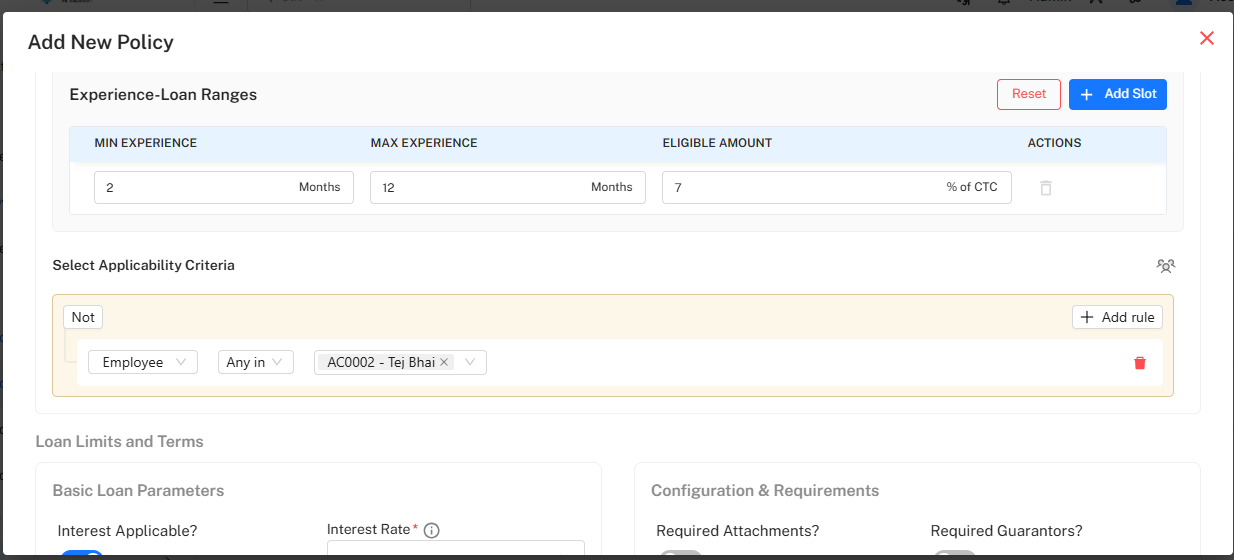

Step 3: Loan Limits and Terms

Configure the financial parameters and operational requirements for loans.

Basic Loan Parameters

!Loan Limits and Terms Configuration

Financial Configuration Core Loan Terms:

-

Interest Settings:

- Interest Applicable: Toggle interest application on/off

- Interest Rate: Set the annual interest rate (e.g., 8%)

-

Amount and Tenure:

- Max Request Amount: Define the upper loan limit (e.g., 50,000)

- Min Tenure Months: Set minimum repayment period (e.g., 6 months)

- Max Tenure Months: Set maximum repayment period (e.g., 24 months)

Configuration & Requirements

Operational Requirements Compliance and Documentation:

- Required Attachments: Specify number of mandatory documents (e.g., 5)

- Guarantor Requirements: Set number of required guarantors (e.g., 2)

- EMI Rounding: Configure rounding mode (Max, Min, Nearest)

- QST Application: Define tax applicability on principal and interest components

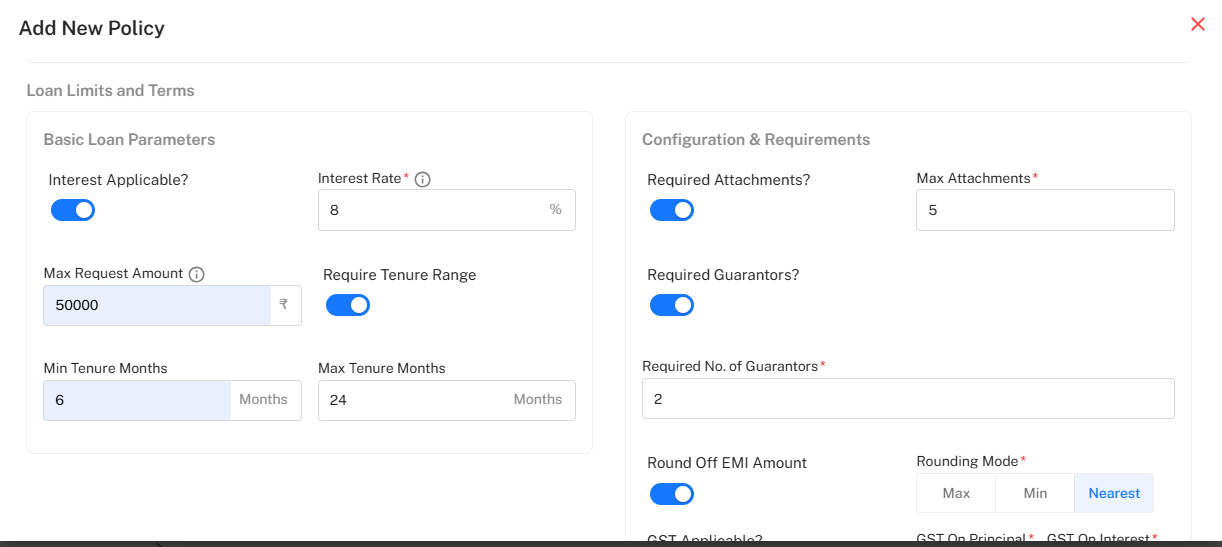

Policy Management and Monitoring

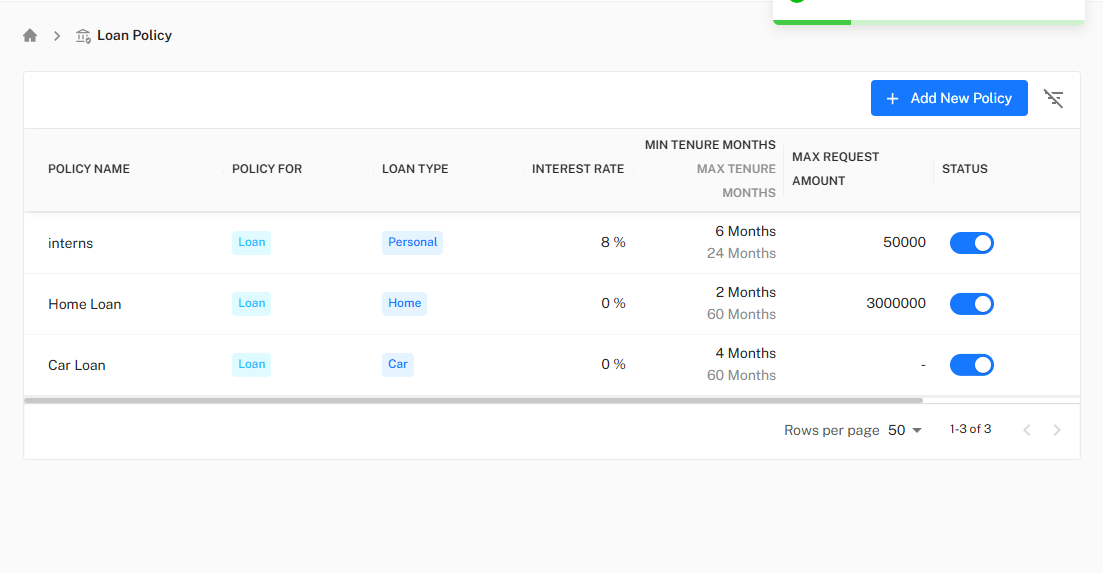

Existing Policies Overview

!Loan Policies Table

Policy Administration Policy Management Features:

- Comprehensive Dashboard: View all policies with key parameters

- Policy Comparison: Compare different loan types and their terms

- Status Management: Track active/inactive policy status

- Parameter Overview: Quick access to interest rates, tenure ranges, and amount limits

- Pagination Control: Navigate through policy lists efficiently

Policy Types Examples

Sample Policy Configurations Common Loan Policy Types:

-

Interns Policy:

- Loan Type: Personal

- Interest Rate: 8%

- Tenure: 6-24 Months

- Max Amount: 50,000

-

Home Loan Policy:

- Loan Type: Home

- Interest Rate: 0%

- Tenure: 2-60 Months

- Max Amount: 3,000,000

-

Car Loan Policy:

- Loan Type: Car

- Interest Rate: 0%

- Tenure: 4-60 Months

*Next: Explore the Salary Advance Policies for configuring short-term employee financial assistance programs with different eligibility and repayment structures.