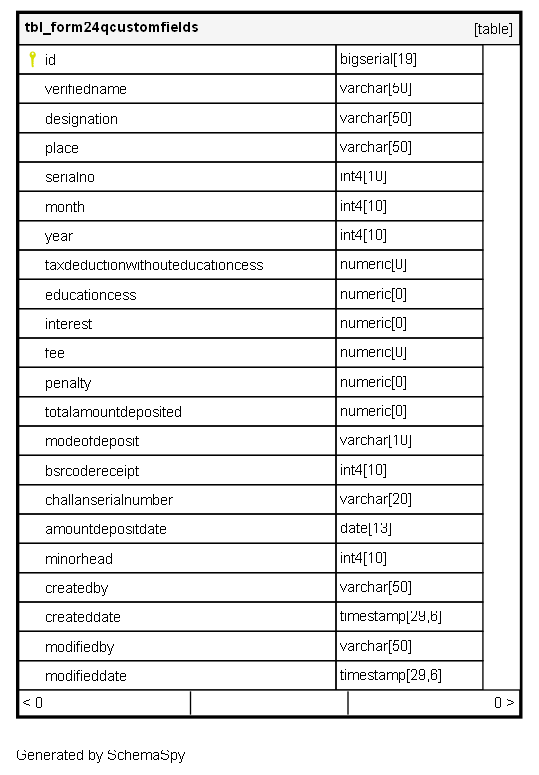

Columns

| Column | Type | Size | Nulls | Auto | Default | Children | Parents | Comments |

|---|---|---|---|---|---|---|---|---|

| id | bigserial | 19 | √ | nextval('tbl_form24qcustomfields_id_seq'::regclass) |

|

|

Primary key |

|

| verifiedname | varchar | 50 | √ | null |

|

|

The name of the person verifying the Form 24Q filing (e.g., the employer/deductor). |

|

| designation | varchar | 50 | √ | null |

|

|

The designation of the verifying person. |

|

| place | varchar | 50 | √ | null |

|

|

The place where the form is being verified/filed. |

|

| serialno | int4 | 10 | √ | null |

|

|

The serial number or index of the challan within the quarterly return. |

|

| month | int4 | 10 | √ | null |

|

|

The payroll month (1-12) to which the deducted tax amount applies. |

|

| year | int4 | 10 | √ | null |

|

|

The payroll year to which the deducted tax amount applies. |

|

| taxdeductionwithouteducationcess | numeric | 0 | √ | null |

|

|

The principal amount of TDS (Tax Deducted at Source) deposited, excluding Education Cess. |

|

| educationcess | numeric | 0 | √ | null |

|

|

The amount of Education Cess and Secondary & Higher Education Cess deposited. |

|

| interest | numeric | 0 | √ | null |

|

|

The amount of Interest paid for late deposit of the TDS. |

|

| fee | numeric | 0 | √ | null |

|

|

The amount of late filing fee paid (if any). |

|

| penalty | numeric | 0 | √ | null |

|

|

The amount of penalty paid (if any). |

|

| totalamountdeposited | numeric | 0 | √ | null |

|

|

The grand total amount deposited via this single challan (TDS + Cess + Interest + Fee + Penalty). |

|

| modeofdeposit | varchar | 10 | √ | null |

|

|

The method of deposit (e.g., E-Payment, Cheque, Cash). |

|

| bsrcodereceipt | int4 | 10 | √ | null |

|

|

The Bank Serial Number (BSR) Code of the bank branch where the tax was deposited. |

|

| challanserialnumber | varchar | 20 | √ | null |

|

|

The unique Challan Identification Number (CIN) or Challan Serial Number. |

|

| amountdepositdate | date | 13 | √ | null |

|

|

The date on which the tax amount was deposited to the government treasury (Challan date). |

|

| minorhead | int4 | 10 | √ | null |

|

|

The minor head of the challan (e.g., typically 200 for TDS on salaries). |

|

| createdby | varchar | 50 | √ | null |

|

|

||

| createddate | timestamp | 29,6 | √ | null |

|

|

||

| modifiedby | varchar | 50 | √ | null |

|

|

||

| modifieddate | timestamp | 29,6 | √ | null |

|

|

Indexes

| Constraint Name | Type | Sort | Column(s) |

|---|---|---|---|

| tbl_form24qcustomfields_pk__tbl_form__3214ec0725b0c3a5 | Primary key | Asc | id |