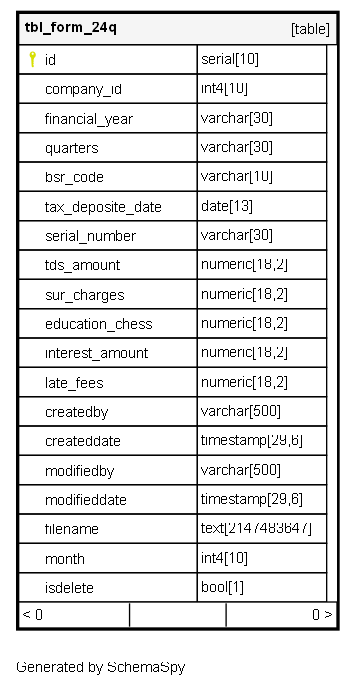

Columns

| Column | Type | Size | Nulls | Auto | Default | Children | Parents | Comments |

|---|---|---|---|---|---|---|---|---|

| id | serial | 10 | √ | nextval('tbl_form_24q_id_seq'::regclass) |

|

|

Primary key |

|

| company_id | int4 | 10 | null |

|

|

FK: public.tbl_company.id |

||

| financial_year | varchar | 30 | null |

|

|

The financial year (e.g., 2024-2025) to which the deducted tax amount applies. |

||

| quarters | varchar | 30 | null |

|

|

The quarter of the financial year (Q1, Q2, Q3, or Q4) to which the deposit belongs. |

||

| bsr_code | varchar | 10 | √ | null |

|

|

The Bank Serial Number (BSR) Code of the bank branch where the tax was deposited. |

|

| tax_deposite_date | date | 13 | null |

|

|

The date on which the tax amount was deposited to the government treasury (Challan date). |

||

| serial_number | varchar | 30 | null |

|

|

The Challan Serial Number (CIN) or Challan Identification Number. |

||

| tds_amount | numeric | 18,2 | null |

|

|

The principal amount of Tax Deducted at Source (TDS) deposited. |

||

| sur_charges | numeric | 18,2 | √ | null |

|

|

The amount of Surcharge deposited (if applicable, based on high employee income). |

|

| education_chess | numeric | 18,2 | null |

|

|

|||

| interest_amount | numeric | 18,2 | √ | null |

|

|

The amount of Interest paid for late deposit of the TDS (if applicable). |

|

| late_fees | numeric | 18,2 | √ | null |

|

|

The amount of late filing fee/penalty paid (if applicable). |

|

| createdby | varchar | 500 | √ | null |

|

|

||

| createddate | timestamp | 29,6 | √ | null |

|

|

||

| modifiedby | varchar | 500 | √ | null |

|

|

||

| modifieddate | timestamp | 29,6 | √ | null |

|

|

||

| filename | text | 2147483647 | √ | null |

|

|

The file name of the TDS return (e.g., FVU file) or the challan receipt uploaded. |

|

| month | int4 | 10 | √ | null |

|

|

The payroll month (1-12) to which the deducted tax amount applies. |

|

| isdelete | bool | 1 | √ | null |

|

|

Soft-delete flag: Indicates if this challan record has been logically deleted. |

Indexes

| Constraint Name | Type | Sort | Column(s) |

|---|---|---|---|

| tbl_form_24q_pkey | Primary key | Asc | id |