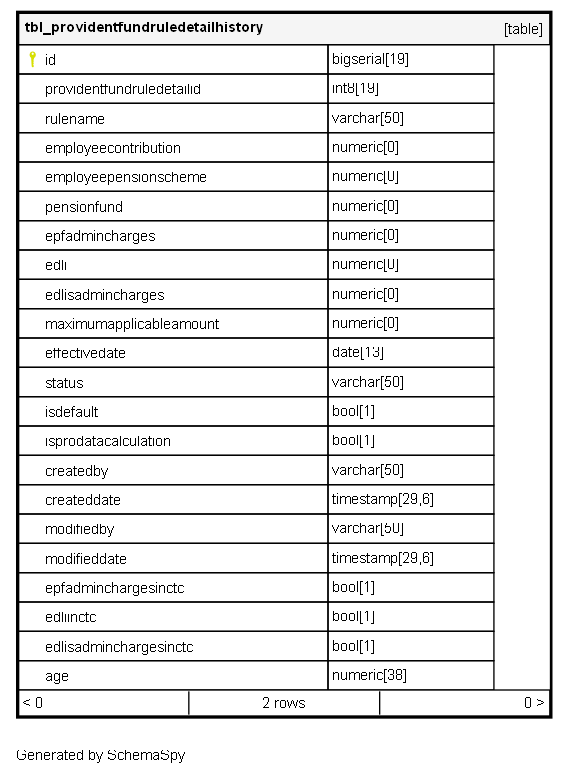

Columns

| Column | Type | Size | Nulls | Auto | Default | Children | Parents | Comments |

|---|---|---|---|---|---|---|---|---|

| id | bigserial | 19 | √ | nextval('tbl_providentfundruledetailhistory_id_seq'::regclass) |

|

|

Primary key |

|

| providentfundruledetailid | int8 | 19 | null |

|

|

FK: public.tbl_ProvidentFundRuleDetail.Id |

||

| rulename | varchar | 50 | null |

|

|

The name given to this set of PF rules (e.g., “Standard 12% Rule”, “New Employee Rate”). |

||

| employeecontribution | numeric | 0 | null |

|

|

The percentage rate of contribution deducted from the employee’s wages (e.g., 12.00). |

||

| employeepensionscheme | numeric | 0 | null |

|

|

The rate used to calculate the Employee Pension Scheme (EPS) portion of the employer contribution (typically capped at 8.33% of a capped salary). |

||

| pensionfund | numeric | 0 | null |

|

|

The overall employer contribution rate for EPF (Employees’ Provident Fund) before splitting with EPS (Pension Scheme). |

||

| epfadmincharges | numeric | 0 | null |

|

|

The percentage rate for the Employer’s contribution towards EPF Administrative Charges (A/c 2). |

||

| edli | numeric | 0 | null |

|

|

The percentage rate for the Employer’s contribution towards Employee Deposit Linked Insurance (EDLI). |

||

| edlisadmincharges | numeric | 0 | null |

|

|

The percentage rate for the Employer’s contribution towards EDLIS Administrative Charges (A/c 22). |

||

| maximumapplicableamount | numeric | 0 | √ | null |

|

|

The maximum Basic + DA salary amount (wage ceiling) on which PF contributions are calculated (statutory limit, e.g., 15000.00). |

|

| effectivedate | date | 13 | √ | null |

|

|

The date from which this specific set of contribution rules and rates became effective for payroll calculations. |

|

| status | varchar | 50 | null |

|

|

The status of this historical rule record (e.g., ACTIVE, INACTIVE). |

||

| isdefault | bool | 1 | null |

|

|

Boolean flag: Indicates if this rule set is the default applicable to all non-special cases. |

||

| isprodatacalculation | bool | 1 | null |

|

|

Boolean flag: Indicates if the PF contribution calculation should be prorated based on the number of days worked in the month. |

||

| createdby | varchar | 50 | null |

|

|

|||

| createddate | timestamp | 29,6 | √ | null |

|

|

||

| modifiedby | varchar | 50 | √ | null |

|

|

||

| modifieddate | timestamp | 29,6 | √ | null |

|

|

||

| epfadminchargesinctc | bool | 1 | false |

|

|

Boolean flag: Indicates if the EPF Administrative Charges are included within the employee’s Cost to Company (CTC). |

||

| edliinctc | bool | 1 | false |

|

|

Boolean flag: Indicates if the EDLI contribution is included within the employee’s Cost to Company (CTC). |

||

| edlisadminchargesinctc | bool | 1 | false |

|

|

Boolean flag: Indicates if the EDLIS Administrative Charges are included within the employee’s Cost to Company (CTC). |

||

| age | numeric | 38 | '58'::numeric |

|

|

The default retirement/age limit used to determine the EPS contribution split (e.g., 58 or 60). |

Indexes

| Constraint Name | Type | Sort | Column(s) |

|---|---|---|---|

| tbl_providentfundruledetailhistory_pk_tbl_providentfundruledeta | Primary key | Asc | id |