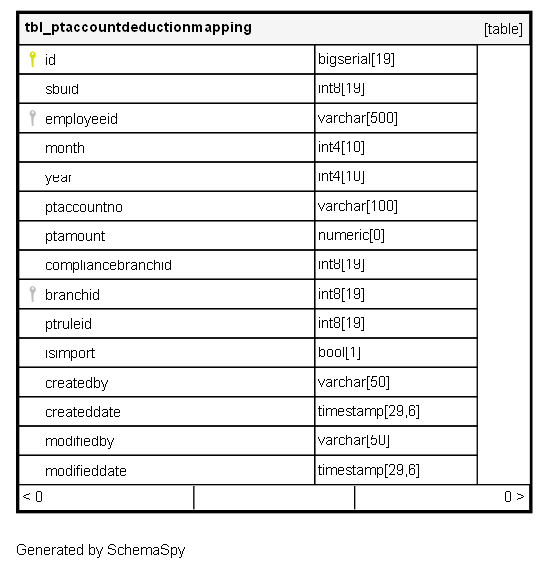

Columns

| Column | Type | Size | Nulls | Auto | Default | Children | Parents | Comments | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| id | bigserial | 19 | √ | nextval('tbl_ptaccountdeductionmapping_id_seq'::regclass) |

|

|

Primary key |

||||

| sbuid | int8 | 19 | null |

|

|

FK: public.tbl_SBU.id |

|||||

| employeeid | varchar | 500 | null |

|

|

FK: public.tbl_employee.employeeid |

|||||

| month | int4 | 10 | null |

|

|

The payroll month (1-12) to which this PT deduction applies. |

|||||

| year | int4 | 10 | null |

|

|

The payroll year to which this PT deduction applies. |

|||||

| ptaccountno | varchar | 100 | √ | null |

|

|

The establishment’s Professional Tax registration account number in the relevant state. |

||||

| ptamount | numeric | 0 | null |

|

|

The final calculated Professional Tax amount deducted from the employee’s salary for this month. |

|||||

| compliancebranchid | int8 | 19 | √ | null |

|

|

FK: public.tbl_compliance_branch.id |

||||

| branchid | int8 | 19 | √ | null |

|

|

FK: public.tbl_branch.id |

||||

| ptruleid | int8 | 19 | √ | null |

|

|

FK: public.tbl_PTRuleHistory.id |

||||

| isimport | bool | 1 | √ | false |

|

|

Boolean flag: Indicates if this record was generated through an import process (e.g., bulk upload) rather than the standard payroll calculation. |

||||

| createdby | varchar | 50 | √ | null |

|

|

|||||

| createddate | timestamp | 29,6 | √ | null |

|

|

|||||

| modifiedby | varchar | 50 | √ | null |

|

|

|||||

| modifieddate | timestamp | 29,6 | √ | null |

|

|

Indexes

| Constraint Name | Type | Sort | Column(s) |

|---|---|---|---|

| tbl_ptaccountdeductionmapping_pk_tbl_ptaccountdeductionmapping | Primary key | Asc | id |