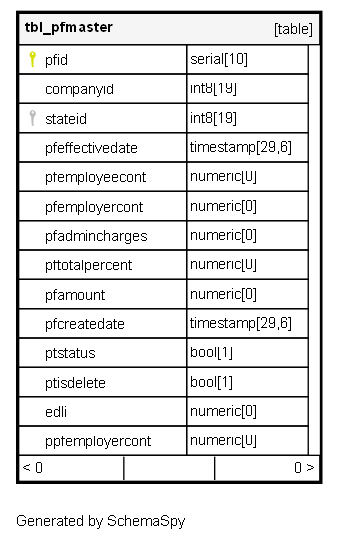

Columns

| Column | Type | Size | Nulls | Auto | Default | Children | Parents | Comments | |||

|---|---|---|---|---|---|---|---|---|---|---|---|

| pfid | serial | 10 | √ | nextval('tbl_pfmaster_pfid_seq'::regclass) |

|

|

Primary key |

||||

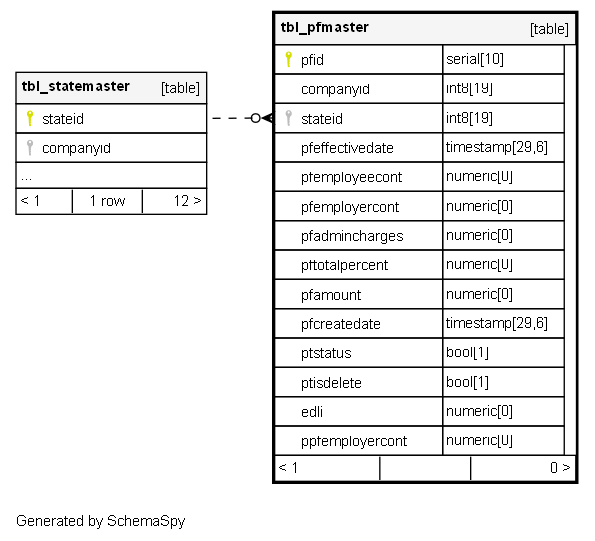

| companyid | int8 | 19 | null |

|

|

FK: public.tbl_company.id |

|||||

| stateid | int8 | 19 | null |

|

|

FK: public.tbl_state.id |

|||||

| pfeffectivedate | timestamp | 29,6 | null |

|

|

The date from which this specific set of PF rules became effective for payroll calculations. |

|||||

| pfemployeecont | numeric | 0 | null |

|

|

The percentage rate of contribution deducted from the employee’s wages for PF (typically 12%). |

|||||

| pfemployercont | numeric | 0 | √ | null |

|

|

The percentage rate of the employer’s contribution allocated to the total Provident Fund (EPF + EPS). |

||||

| pfadmincharges | numeric | 0 | √ | null |

|

|

The percentage rate for the Employer’s contribution towards EPF Administrative Charges (A/c 2). |

||||

| pftotalpercent | numeric | 0 | √ | null |

|

|

The calculated total percentage contribution (e.g., sum of employer and employee percentages). |

||||

| pfamount | numeric | 0 | √ | null |

|

|

A flat amount or maximum ceiling amount applicable for PF calculation (if the rule uses a fixed ceiling). |

||||

| pfcreatedate | timestamp | 29,6 | √ | null |

|

|

The date this rule record was created in the system. |

||||

| ptstatus | bool | 1 | √ | true |

|

|

Boolean flag: Appears to be a status field, though named with ‘PT’ (Professional Tax), likely indicating if the PF rule set is currently active. |

||||

| ptisdelete | bool | 1 | √ | false |

|

|

Soft-delete flag: soft-delete field, though named with ‘PT’, indicating if the PF rule record is logically deleted. |

||||

| edli | numeric | 0 | √ | null |

|

|

The percentage rate for the Employer’s contribution towards the Employee Deposit Linked Insurance (EDLI) scheme. |

||||

| ppfemployercont | numeric | 0 | √ | null |

|

|

The portion of the employer’s contribution specifically allocated to the Employee Pension Scheme (EPS), or a similar pension component. |

Indexes

| Constraint Name | Type | Sort | Column(s) |

|---|---|---|---|

| tbl_pfmaster_pk_tbl_pfmaster | Primary key | Asc | pfid |